Traditional index funds track a market index - hence the name. That may be the S&P 500 or NASDAQ or a smaller segment of the market. Non-traditional index funds, on the other hands, track customized index in order to achieve greater performance than their traditional counterparts. Non-traditional funds may also use leverage, such that they return a multiple of one of these customized indexes, thus ratcheting up potential returns (and potential losses) to an even greater extent.

FINRA Disciplinary Action Report - September 2017

FINRA Disciplinary Action Report: August 2017

FINRA Disciplinary Action Report - October 2016

FINRA Broker Disciplinary Action Report: April & May 2016

FINRA DECEMBER 2015 BROKER DISCIPLINARY ACTION REPORT

Each month and again on a quarterly basis, the agency that regulates the financial industry, FINRA (Financial Industry Regulatory Authority), produces a detailed report of disciplinary actions recently taken against brokerage firms and brokers. This list of alleged wrongdoing and misconduct reads a lot like a police blotter on money matters. We strongly encourage any investor who suspects their broker and/or broker-dealer of having lost them money on dubious terms to at least skim this report to see if you recognize any names, schemes, products, or securities.

FINRA NOVEMBER 2015 BROKER DISCIPLINARY REPORT

FINRA September 2015 Broker Disciplinary Action

Non-Traditional ETFs, Popular and Perilous

News of the perils for retail investors of the complex financial products known as non-traditional ETFs has been fast and furious this year. This shouldn’t be too surprising. Non-traditional ETFs are the “it” investment these days: they have continued to grow in popularity, with their largest year-end proportion ever in 2013. According to Morningstar reporting, these exotic funds now account for 13.2% of all fund assets as of November. If you’re not familiar with non-traditional ETFs, chances are you will be soon: their popularity, in spite of several high profile lawsuits related to inappropriate use and unsuitability claims, seems unstoppable. The latest lawsuit involves a broker-dealer called “Stifel Financial Corporation.” According to a recent article, the securities industry watchdog FINRA (Financial Industry Regulatory Authority), fined and censured Stifel Nicolaus and Century Securities $550,000 and ordered restitution payments of $475,000 to a combined more than 60 customers for misconduct related to the recommendation and sale of leveraged and inverse ETFs.

photo by Katrina.Tuliao, Creative Commons

And it’s happening all the time.

For the very simple reason that far too many brokers who recommend and sell non-traditional ETFs to customers do not understand how they work. And their brokerage firms do not educate and/or supervise these brokers adequately.

FINRA’s crackdown on offenses connected to non-traditional ETFs is good news for investors whose portfolios have been damaged by these products and their improper use by clueless brokers.

Now, we’ve already said a lot about the havoc non-traditional ETFs have wreaked--but what are they?

Well, since you asked… Non-traditional ETFs are complex financial products designed to achieve specific performance results on a daily basis. An ETF or “Exchange-Traded Fund” is typically a registered investment company whose shares represent an interest in a portfolio of securities that are linked to a specific benchmark or index. (Some ETFs, for example, those invested in commodities or currencies, may not however be registered). ETFs are funds, but unlike traditional mutual funds, they are traded throughout the day on a securities exchange at market prices.

Non-traditional ETFs include both leveraged and inverse ETFs as well as leveraged inverse ETFs. Leveraged ETFs aim to deliver multiples of the performances of the underlying index or benchmark that the fund is tracking. Inverse ETFs or “short funds” on the other hand deliver the opposite of the index or benchmark. Some ETFs are both leveraged and inverse, in which case they combine qualities from both categories of ETFs, hoping to deliver multiples on the inverse of the performance of the index or benchmark. These are called “leveraged inverse ETFs” or “ultra-short funds.” To achieve results, non-traditional ETFs deploy various investment strategies that include swaps, futures contracts, and other derivative instruments. Again, and most crucially, both leveraged and inverse ETFs are designed to give results on a daily basis only.

On a daily basis, non-traditional ETFs “reset.” This key characteristic of the product is the one most often misunderstood or misapplied by investors and professional financial advisors alike. Since leveraged and inverse ETFs are intended for daily use only, holding shares in them for longer-term investment can be dangerous due to the effects of compounding, particularly in volatile markets. Non-traditional ETFs can be an effective means of trading and shorting within a complex investment strategy when closely monitored by a financial professional. However, they are typically not suitable for intermediate or long-term investment and any financial advisor who uses them in this way may be guilty of misconduct and/or unsuitability.

If you’ve gotten this far, you now probably know more than most brokers about how this product works.

If you or anyone you know has been the victim of broker misconduct or investment fraud, please contact us immediately at 1-855-462-3330.

Beware of Non-traditional ETFs

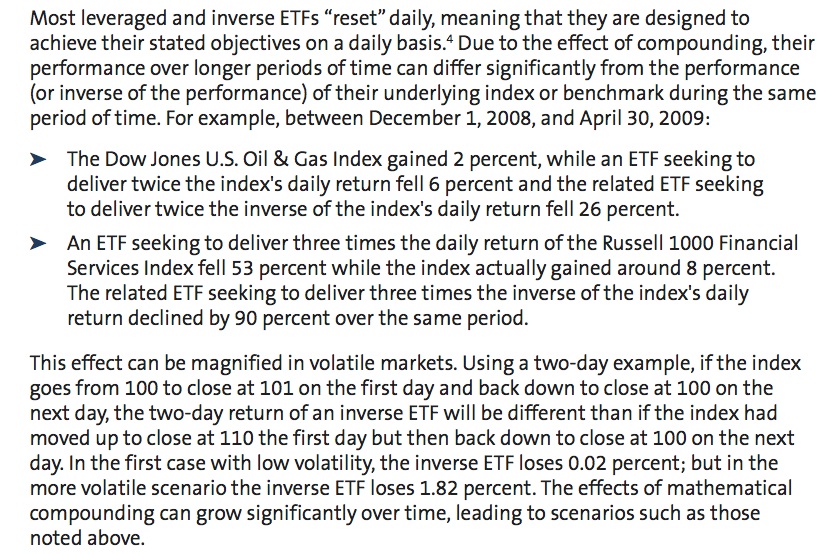

SInce The Green Firm is currently pursuing a case involving a particularly egregious abuse of non-traditional ETFs, we thought it might be useful to revisit these exotic investment products and explain why they tend to be misunderstood and misused by stock brokers more accustomed to a traditional "buy-and-hold" strategy. Traditional investing principles urge brokers to "buy low and sell high." Often this means holding onto a specific financial product or stock for a long period of time while waiting for it to arrive at its "true," projected, or peak value, at which point the product is sold before it has a chance to decline. Generally, this type of traditional "value" investing is stable, low risk and low return; it also happens to be suitable for customers with a low-risk tolerance. Non-traditional ETFs, on the other, are complex, high-risk financial products that are designed to perform radically differently. According to FINRA's website, leveraged and inverse ETFs "commonly represent an interest in a portfolio of securities that track an underlying benchmark or index [not the stock market as a whole]. A leveraged ETF generally seeks to deliver multiples of the daily performance of the index or benchmark that it tracks. An inverse ETF generally seeks to deliver the opposite of the daily performance of the index or benchmark that it tracks. Inverse ETFs often are marketed as a way for investors to profit from, or at least hedge their exposure to, downward-moving markets. Some ETFs are both inverse and leveraged, meaning that they seek a return that is a multiple of the inverse performance of the underlying index." One should note that inverse ETFs are particularly tricky, since they are hedging instruments, and thus are intended to perform well in volatile markets. While a financial advisor may describe these non-traditional ETFs as a product that would be suitable in a down market, given the fact that these products "reset" daily (meaning they are designed to meet their objectives on a daily basis), even in a declining market these non-traditional ETFs should not be held for longer than one trading session. Here are some helpful examples from FINRA's Regulatory Notice 09-31:

Many an unfortunate customer has lost money due to an uninformed or negligent broker keeping them invested in leveraged and inverse ETFs inappropriately. We have found in our cases that oftentimes the individual financial advisor does not understand the nature or use of non-traditional ETFs, and so are forced to look at the firm they work for in seeking an answer to the question of why they are investing customers in products they themselves have no grasp of. In many cases, branch managers and even the brokerage firms are not nearly familiar enough with these complex products. Clearly, ETFs can be counterintuitive and risky financial products that are not suitable for every investor, nor understood or properly used by every financial advisor or firm.

If you or someone you know has lost money as a result of improper use of non-traditional ETFs, please contact us.